property tax in nice france

Agents fees where not paid by the seller. There are two main property taxes in France plus a wealth tax according to Jessica Duterlay a tax associate at Attorney-Counsel a law firm with offices in London and.

French Property Tax Hikes Scheduled For 2022

If your property income from furnished rentals is less than 70000 in revenue per year you may benefit from the micro regime.

. The rate of stamp duty varies slightly between the departments of France and significantly depending on the age of the property. Cabinet Roche Cie English speaking accountant in Lyon France. The total taxes and fees can add up to as much as 20 of the price of a property depending on whether the agents fees are paid by buyer or seller.

Any assets located outside of France will be exempt from the ISF for 5. Here is how it is calculated. Anyone who lives in France pays the tax dhabitation.

The two main property taxes are. The rate of stamp duty varies slightly between the departments of France and depending on the age of the property. From 0 to 800000.

You are liable for this tax if the net value of your property in France exceeds 1300000 euros. If you become resident in France you will only be taxed on your French assets for the first 5 years of residency. The tax applies to all worldwide property regardless of its location on the territory of France or abroad.

No matter if you own or rent the place as a. For properties more than 5 years old stamp duty is. This amount is further increased by 6000 for each additional dependant in the household.

IFI tax rates depending on the property value. Any person living abroad and owner of real estate in France is subject to French property tax. Any owner of real estate in France on 1 st.

The tax rate varies between 050 and 150 of the declared value of. Your capital gains are the sales price less your cost basis and selling expenses. Individuals who are residents of another state are also liable to the IFI on.

A homebuyer can expect to pay about 7 of the purchase price of an existing property in taxes and fees such as stamp duty notary fees and transfer taxes he said. Assets must be consolidated for all members of the household and couples must make a joint declaration whether married or not. French wealth tax only kicks in at net assets 13 million.

Taxe foncière Land Tax Taxe dhabitation Housing or Residence Tax There are currently reforms underway to abolish the Taxe. This will be followed by a 65 per cent reduction in 2019 and a 100 per cent. There are 2 types of property taxes in France the taxe dhabition and the taxe foncière.

There is no exemption. That is to say that you declare everything you have received. The capital gains on non-primary residences are generally taxable in France.

Non-residents who live and work in the country pay taxes on property located within the territory of France. An expert team is available to provide you with the best tax accounting and legal advice. For properties more than 5 years old stamp.

Non French Tax Residents Benjaminpratt France Monaco

What Are Property Taxes Like In The South Of France Mansion Global

French Property Income Tax Non Resident Tax Return Filing Pti

French Property Taxes Set To Reach Record Levels In 2022

Taxes On Property In France Blevins Franks Advice

The Tax Implications Of Owning A French Property Complete France

French Property Taxes Taxe D Habitation And Taxe Fonciere Frenchentree

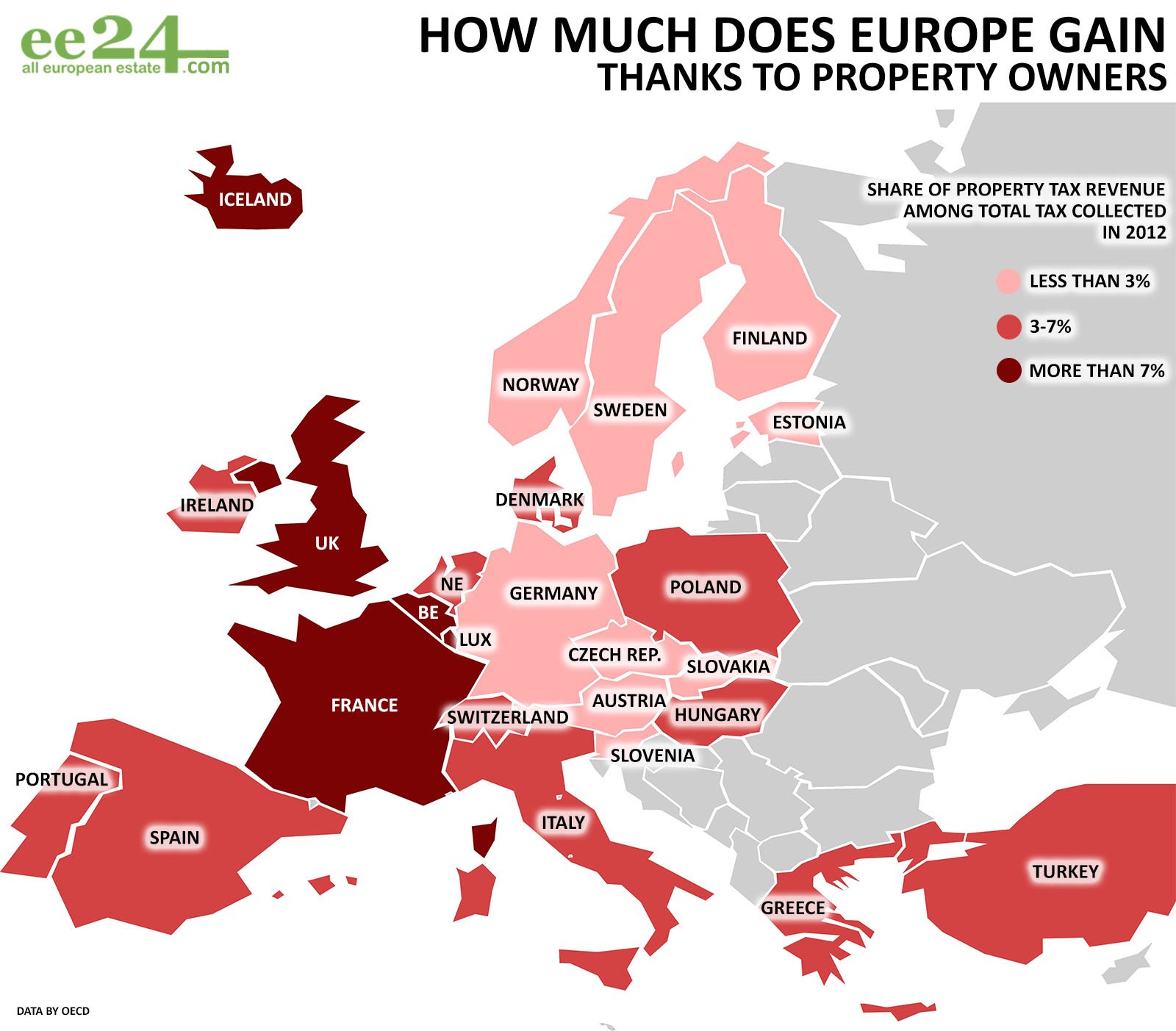

Rating Of Property Tax From Affordable Estonia To Expensive France Ee24

Taxes In Nice France Teleport Cities

What Second Home Owners Need To Know About 2023 French Property Taxes

French Property Tax For Non Residents Ptireturns Com Blog

French Tax Collectors Use A I To Spot Thousands Of Undeclared Pools The New York Times

Tax Implications Of Owning Property Abroad Chestnut Park Real Estate Ltd Brokerage Sw Ontario Lake Simcoe

French Property Tax Explained Property For Sale In France Cle France The French Property Network

Taxes On Property In France French Touch Properties

Property Tax Assistant Average Salary In France 2022 The Complete Guide

Property Taxes In France Total Buying Abroad

Tax Aspects Of Owing Property In France Or What Is Real Value Of Your French Villa Part Ii Glagoliza News